Top 8 Digital Banking Cards.

November 2025

Compare the best (Credit/ Debit/ Virtual) cards providers, Choose & Get your card

| Brands | Accounts & Pricing | Card | Highlights | Our Rating | Next Step | |

|---|---|---|---|---|---|---|

| 1 |

|

|

|

|

98

More info+ |

Go To Site |

| 2 |

|

|

|

|

96

More info+ |

Go To Site |

| 3 |

|

|

|

|

92

More info+ |

Go To Site |

| 4 |

|

No fees within plan limits. T&C apply. Third party providers may charge fees. |

|

|

89

More info+ |

Go To Site |

| 5 |

|

|

|

|

86

More info+ |

Go To Site |

Everything you should know about Neobanks

2. Is it safe to use Neobanks?……►

3. The advantages of Neobanks compared to Traditional banks……►

4. What do I need in order to set up an account?……►

5. How to compare and choose the right Neobank for me?……►

6. Do I qualify to open my own account?……►

7. Which is the best Neobanks in my country?……►

8. What service should I use to set up a business account?……►

9. Does paying for a premium account worth it?……►

What is a Neobank?

A neobank, also known as a digital bank or challenger bank, is a type of financial institution that operates exclusively online without traditional physical branch networks. Here are some key features of neobanks:

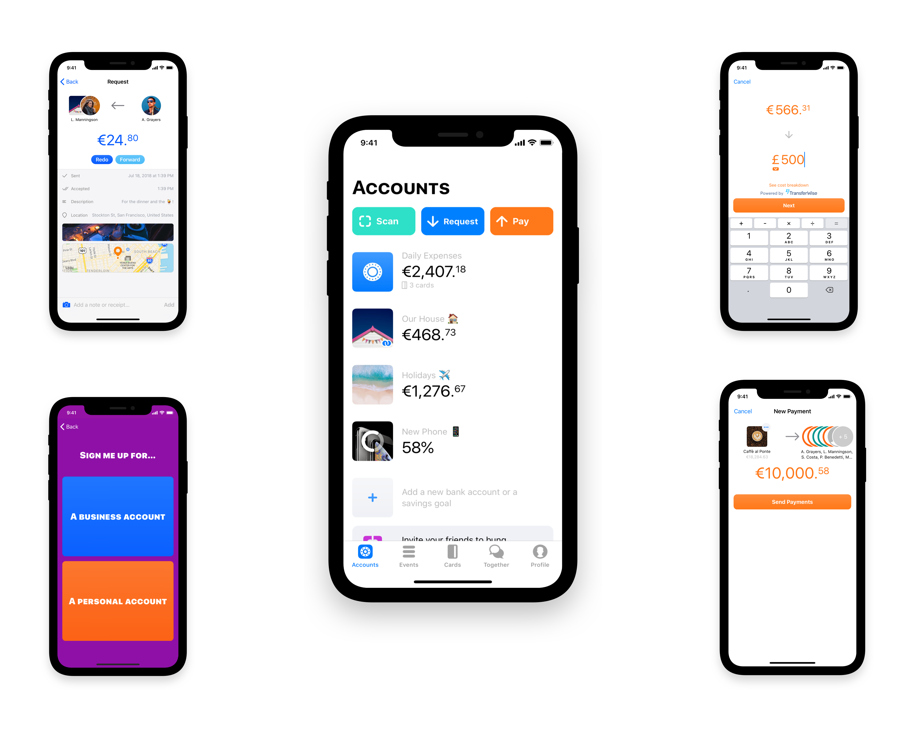

- Digital-First Approach: Neobanks primarily operate through mobile apps and websites, providing banking services via digital platforms.

- Low Fees: They often offer lower fees compared to traditional banks, as they save on costs associated with maintaining physical branches.

- User Experience: They focus on delivering a seamless and user-friendly experience, often incorporating advanced features like real-time notifications, budgeting tools, and integration with other financial services.

- Innovative Services: Neobanks typically offer innovative services such as early access to paychecks, cryptocurrency transactions, and more flexible saving and investment options.

- Target Audience: They usually target tech-savvy customers who are comfortable managing their finances online.

Examples of neobanks include N26, Revolut, and Chime. These banks are gaining popularity, particularly among younger generations and those looking for more convenience and lower costs in their banking services.

Is it safe to use Neobanks?

Using neobanks can be safe, but it depends on several factors. Here are some points to consider regarding the safety of neobanks:

- Regulation: Ensure that the neobank is regulated by appropriate financial authorities. In the European Union, for instance, look for banks that are authorized by the European Central Bank or national financial regulators.

- Deposit Insurance: Check if your deposits are insured. In the EU, reputable neobanks often have deposit insurance schemes that protect deposits up to €100,000.

- Security Measures: Neobanks typically implement robust security measures, such as encryption, two-factor authentication, and biometric verification. Ensure the neobank you choose uses these protections.

- Reputation and Reviews: Research the neobank’s reputation by reading user reviews and expert opinions. Look for any history of data breaches or financial issues. Here you can find our expert's reviews of the leading Neobanks

- Customer Support: Reliable customer support is crucial. Make sure the neobank offers accessible and responsive customer service to address any issues promptly.

- Financial Stability: Consider the financial stability of the neobank. Established neobanks with significant backing from reputable investors or partnerships with traditional banks can be more secure.

While neobanks offer many advantages, including lower fees and innovative services, it’s important to conduct thorough research and ensure the neobank you choose is trustworthy and secure.

The advantages of Neobanks compared to Traditional banks

Neobanks offer several advantages over traditional banks, which make them appealing to a growing number of customers. Here are some key benefits:

- Lower Fees: Neobanks often have lower or no fees for account maintenance, transactions, and foreign currency exchanges compared to traditional banks.

- Convenience: As digital-first institutions, neobanks allow customers to manage their finances entirely through mobile apps or online platforms, eliminating the need to visit physical branches.

- User Experience: Neobanks typically offer modern, user-friendly interfaces with intuitive designs, real-time notifications, and easy access to account information and services.

- Innovation: They often provide advanced features such as budgeting tools, spending analytics, instant transfers, early access to paychecks, and integration with other financial services and apps.

- Speed: Opening an account with a neobank is usually faster and simpler than with a traditional bank, often taking just a few minutes online.

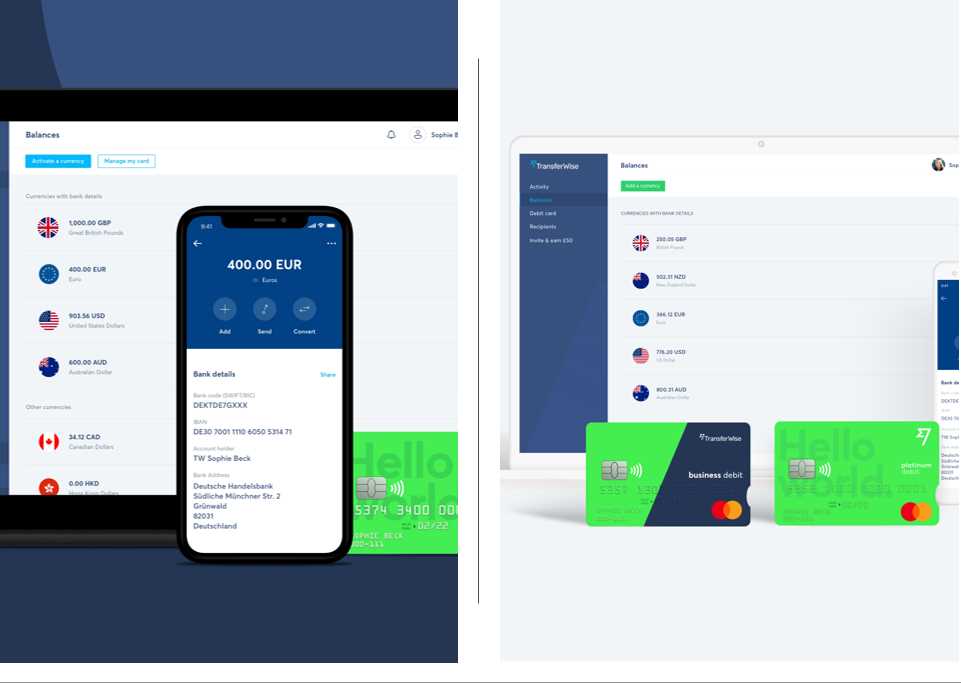

- Global Access: Many neobanks offer multi-currency accounts and competitive exchange rates, making them ideal for frequent travelers and those with international financial needs.

- 24/7 Access: Customers can access their accounts and perform transactions at any time, without being limited by the operating hours of physical branches.

- Personalization: Neobanks often use data analytics to offer personalized financial advice, spending insights, and tailored financial products.

- Transparency: They generally provide clearer and more straightforward terms and conditions, with fewer hidden fees and more transparent pricing structures.

- Environmental Impact: By operating without physical branches, neobanks typically have a smaller environmental footprint compared to traditional banks.

While these advantages make neobanks attractive, it’s important to evaluate individual neobanks for their reliability, regulatory compliance, and customer service to ensure they meet your specific banking needs.

What do I need in order to set up an account?

Setting up an account with a neobank is typically straightforward and can often be done entirely online. Here are the general steps and requirements:

- Smartphone or Computer: You’ll need a device with internet access, such as a smartphone, tablet, or computer.

- Neobank App or Website: Download the neobank’s app from the App Store or Google Play, or visit their website if they offer account setup via a browser.

- Personal Information: Provide basic personal details such as your full name, date of birth, and contact information (email and phone number).

- Identification Documents: Upload a valid form of identification. This could be a passport, national ID card, or driver’s license. Some neobanks might require you to take a photo of the document and a selfie for verification.

- Proof of Address: Some neobanks may ask for proof of address, such as a utility bill, bank statement, or rental agreement. This might be required to comply with regulatory requirements.

- Tax Information: You may need to provide tax identification information, especially if the neobank operates in multiple countries and needs to comply with international tax regulations.

- Security Setup: Set up security features such as a PIN, password, or biometric verification (fingerprint or facial recognition).

- Funding the Account: You might be asked to make an initial deposit to activate the account. This can typically be done via bank transfer, debit card, or other payment methods supported by the neobank.

- Agreement to Terms and Conditions: Read and agree to the neobank’s terms and conditions, privacy policy, and any other legal agreements.

- Optional Information: Some neobanks might offer additional services or features that require extra information, such as linking other bank accounts or setting up direct deposit details.

Once you’ve completed these steps, your account should be ready for use. The exact requirements and process can vary slightly depending on the neobank and the country’s regulatory environment.

How to compare and choose the right Neobank for me?

Comparing and choosing the right neobank involves evaluating various factors based on your personal banking needs and preferences. Here’s a step-by-step guide to help you make an informed decision.

Do I qualify to open my own account?

To determine if you qualify for an account with a neobank, you can use the general requirements I listed earlier. Here’s a checklist you can go through to see if you meet the common qualifications:

- Are you at least 18 years old (or have a parent/guardian if you are a minor)?

- Do you have a valid government-issued photo ID (passport, national ID card, or driver’s license)?

- Can you provide proof of your residential address (utility bill, bank statement, rental agreement)?

- Do you have a tax identification number (TIN) or social security number (SSN)?

- Do you have a valid email address and phone number?

- Do you have a smartphone, tablet, or computer with internet access?

- Do you reside in a country where the neobank is authorized to operate?

- Are you able to make an initial deposit if required (usually minimal or not required at all)?

- Are you willing to agree to the neobank’s terms and conditions and privacy policy?

- Are you prepared to provide financial status information if applying for credit or loan services (usually not required for basic accounts)?

- Are you comfortable undergoing a credit check if applying for credit or loan services (usually not required for basic accounts)?

If you can answer "yes" to these questions, you likely qualify for an account with most neobanks. Some Neobank do not require proof of address, TIN or credit check to open an account. see the full list here.

If you have any specific neobank in mind, it’s a good idea to look for our expert's review of its services and continue to visit their website or contact their customer support to confirm their specific requirements. Remember, each Neobank has its own criteria and requirements for onboarding new clients and different banks addresses different audiences, so don't give up if your first choice is not available for you.

Which is the best Neobanks in my country?

The Leading Neobank in France

The Leading Neobank in Germany

The Leading Neobank in The Netherlands

What service should I use to set up a business account?

Setting up a business account with a neobank can be a great choice for many entrepreneurs and small business owners due to their convenience, lower fees, and advanced features. Follow this link to find out more about Neobanks Business account and to see our expert's top recommendations.

Does paying for a premium account worth it?

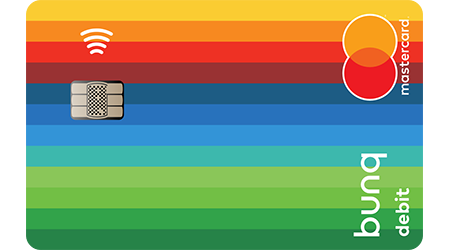

Although one of the most apealing features of Neobanks is the option they give their customers to open an account for free, most of the Neobanks also offer a premium account, which offers advances and more comprehensive services at additional monthly/yearly fees. Some of the features you might consider when evaluating your need for a premium account are such as International Travel Insurance offered by Revolut Premium/Metal, Unlimited free ATM withdrawals worldwide offered by N26 You/Metal and Interest on Balances offered by Bunq Premium/SuperGreen, and other additional perks.

Click Here to see our top picks of Premium accounts and what they offer.

If you are looking into Business account and considering investing on a premium account, here is a brief guide you might want to look into.

Key Considerations:

Features and Benefits:

- Enhanced Services: Premium accounts often come with additional features such as higher transaction limits, faster processing times, priority customer support, advanced reporting, and more extensive integration options.

- Expense Management: If your business relies heavily on expense management, premium accounts may offer more sophisticated tools like automated reconciliations, advanced reporting, and unlimited prepaid cards.

- Multi-Currency Management: Premium accounts might provide better exchange rates, reduced fees on currency conversions, and the ability to hold and manage more currencies simultaneously.

Cost vs. Value:

- Fees: Compare the monthly or annual fees of the premium account against the savings and benefits you’ll gain from the enhanced services. Calculate whether the added value outweighs the additional costs.

- Savings on Transactions: If your business frequently makes international transactions or deals with multiple currencies, the savings on transaction fees and better exchange rates could justify the cost of a premium account.

Business Needs:

- Transaction Volume: If your business handles a high volume of transactions, a premium account’s higher limits and reduced fees might be beneficial.

- Customer Support: Access to priority customer support can be crucial if you need timely assistance and quick resolution of issues.

Scalability:

- Growth Plans: Consider your business growth plans. A premium account may offer scalable solutions that grow with your business, providing more flexibility and advanced tools as your needs evolve.

Additional Services:

- Integration with Accounting Software: Premium accounts often offer better integration with accounting software and other business tools, which can save time and improve efficiency.

- Advanced Security Features: Enhanced security features offered with premium accounts can provide added peace of mind for your business finances.

Conclusion:

Paying for a premium account with your neobank can be worth it if the additional features and benefits align with your business needs and provide significant value. It’s essential to assess the specific offerings of the premium account, compare them with the costs, and determine whether they will provide tangible benefits to your business operations.

If your business requires advanced features, higher transaction limits, better exchange rates, or enhanced customer support, a premium account could be a valuable investment. However, if your business operations are relatively simple and the standard account meets your needs, a premium account might not be necessary.

Recommendations:

- Evaluate Current Needs: Assess your current business requirements and identify any gaps that a premium account could fill.

- Calculate Potential Savings: Compare the fees of the premium account with the potential savings on transactions and other benefits.

- Trial Period: If possible, take advantage of any trial period or flexible plans to test the premium features before committing long-term.

- Seek Feedback: Look for reviews and feedback from other businesses using the premium account to understand their experiences and benefits.

By carefully considering these factors, you can make an informed decision about whether a premium account is worth the investment for your business.

You can visit the following link to check out our latest Business Neobanks accounts Ratings.

The Advantages of Neobanks

Always Available

Now you can Fully manage your bank account on-the-go using the app or desktop site

Financial Control

Control your money with unique budgeting tools and real-time actions notifications

Safe & Secure

These services uses the highest level of security standards, regulations and funds protection, so your money will be safe

Stay On The Safe Side & Make Smarter Decision

All of the services presented in our website are regulated and licenced.

Top8neobanks' team of fintec experts took an in depth reviews and examinations of these services and thier products in order to give you, the customer, as much added value as possible and allowing you to make smarter and safer decision before upgrading your financial life and opening your first digital bank account with one of the many services available in the market.

If you find anything incorrect with the data presented both on our site and/or the services, please feel free to contact us via email, and we will do our best to correct it and inform others.

Thank you for choosing our service and we hope you will be satisfied from choosing to be part of the revolution of banking re-defind.