Advantages of digital banking for businesses

Online and mobile banking services offer a multitude of advantages to businesses, streamlining financial management and enhancing operational efficiency.

Wether you are a Large business owner, SME or a Freelancer - Managing your financials using an online banking service can have a hugh benefit along the way, helping you to focus more on your business rather then the surroundings while staying on top of your financials.

Here's a summary of the key benefits of Online and mobile banking services for Businesses, as well as our Editor's top picks for each account type:

- Most convenient app to manage your business account

- Best account for SMEs

- Best account for International & Multi-Currency Business account

- Best Expense management solution for Businesses

- most cost-effective account for Small Businesses

Convenience and Accessibility

Online and mobile banking significantly elevate convenience for business financial management. The ability to perform banking tasks from anywhere at any time—be it making transfers, checking account balances, or approving transactions—means businesses can operate more fluidly. This round-the-clock access is crucial for businesses that operate across different time zones or need to make immediate financial decisions outside traditional banking hours.

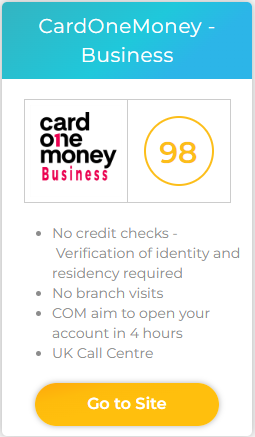

Our Editors' choice for the most convenient app to manage your business account: CardOneMoney Business

- Features: CardOneMoney provides business banking services with features like expense tracking, invoicing, and direct integration with accounting software.

- Advantages: Fast account opening process, No credit checks (verification of identity and residency required), and tailored services for small businesses and freelancers.

- Availability: Primarily in the UK.

Proceed to CardOneMoney Business

Read more about CardOneMoney Business

Enhanced Cash Flow Management

Streamlined Financial Operations through Integration

Integrating banking services with accounting and financial software automates and streamlines financial operations. This integration reduces manual data entry, minimizes errors, and ensures that financial records are always up to date. Automated reconciliation, facilitated by these integrations, saves significant time during financial reporting and tax filing processes, making the entire financial management ecosystem more efficient.

Our Editors' choice for the best account for SMEs - Equals Money

Proceed to Equals Money Business

Read more about Equals Money Business

Advanced Security Features

Customizable Alerts and Notifications

Customizable alerts and notifications offer businesses the ability to monitor their finances proactively. Setting up alerts for low balances, large transactions, or unusual activity helps businesses to stay on top of their financial health and respond promptly to any issues. This feature not only aids in managing finances more effectively but also plays a crucial role in enhancing security.

Access to a Range of Financial Products

Simplified International Operations

Online and mobile banking platforms often support multi-currency transactions and accounts, simplifying the process of managing international operations. Businesses can hold, transfer, and receive funds in various currencies without needing separate bank accounts in different countries. This feature is particularly advantageous for businesses with a global customer base or suppliers, as it can reduce exchange rate losses and transaction fees.

- Features: Revolut Business offers multi-currency accounts, expense management, corporate cards, and integrations with various business tools like accounting software.

- Advantages: Competitive exchange rates, fee-free international payments, and scalable plans suitable for businesses of different sizes.

- Availability: Available in multiple countries, including most of Europe, the US, and beyond.

Read more about Revolut Business

Real-Time Decision Making

Digital Loan Applications and Management

The digitalization of loan applications and management processes through online banking platforms streamlines access to financing. Businesses can apply for loans, track the status of applications, and manage loan repayments online, reducing the need for physical paperwork and in-person visits to banks. This efficiency in managing credit can be critical for businesses looking to quickly capitalize on growth opportunities or manage cash flow challenges.

Eco-friendly and Cost-effective

Beyond the environmental benefits of reducing paper usage, online and mobile banking services can also be more cost-effective for businesses. By eliminating the need for physical checks, postage, and manual processing of payments, businesses can reduce operational costs. Furthermore, digital record-keeping through online platforms simplifies audit processes and financial compliance, potentially reducing the costs associated with financial reporting and compliance management.

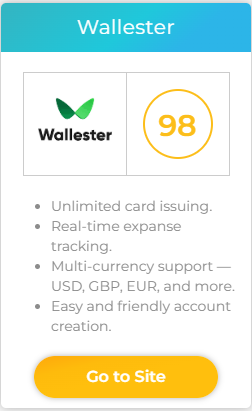

Our Editors' choice for Best Expense management solution for Businesses - Wallester

- Features: Wallester offers Free corporate cards for any business, expense management solutions, invoices management, and integrations with various business tools like accounting software.

- Advantages: Multi-currency support with Competitive exchange rates, 300 virtual cards at no cost, Real-time tracking and support and scalable plans suitable for businesses of different sizes.

- Availability: Available in UK, France and Estonia.

Enhanced Collaboration and Delegation

Online banking platforms allow for the setting up of multi-user access, enabling business owners to delegate banking tasks while maintaining control over the extent of each user's access. This feature facilitates collaboration among team members and ensures that financial management responsibilities can be shared without compromising security. It allows for more efficient distribution of tasks like payments processing, financial monitoring, and report generation among team members.

Access to a Wealth of Financial Insights

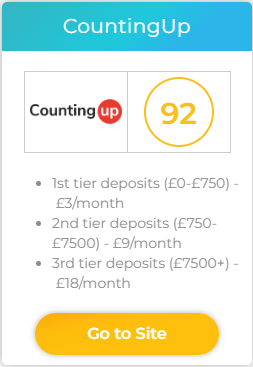

Our Editors' choice for most cost-effective account for Small Businesses - CountingUp

- Features: CountingUp offers Fee-free banking for everyday transactions, multi-currency support, VAT return preparation, Profit and Loss Statements and Automated Bookkeeping features.

- Advantages: Countingup is a powerful tool for small businesses, freelancers, and sole traders looking for a streamlined solution to manage their banking and accounting needs

- Availability: Available in the UK only.

Custom Financial Solutions

Online and mobile banking platforms often provide a range of customizable financial solutions tailored to the specific needs of businesses. Whether it's setting up automated savings plans, customizing payment workflows, or integrating with specialized financial management software, these platforms offer the flexibility to tailor financial operations to the unique needs of each business.

online and mobile banking services offer businesses a comprehensive set of tools designed to enhance financial management, improve operational efficiencies, and support strategic decision-making. The continuous evolution of digital banking technologies promises even greater advantages, ensuring that businesses can stay competitive in an increasingly digital world.