N26 Review

All you need to know about N26 Bank

Company Information:

In today's fast-paced world, traditional banking methods can feel outdated. N26, founded in 2013 by Valentin Stalf and Maximilian Tayenthal, sought to revolutionize the banking experience for modern mobile lifestyles. With over 3.5 million customers across 26 markets, N26 has emerged as a top 10 FinTech company globally, offering a range of innovative features and services.

Pros & Cons

Pros:

- Great User Experience: N26 offers a seamless and intuitive mobile app interface, making account management effortless.

- Useful Features: From managing transactions to setting spending limits, N26 provides a suite of tools to meet users' financial needs.

- Convenience for UK Customers: UK users receive account numbers and sort codes, enhancing accessibility.

- Support for Mobile Payment: N26 supports Apple Pay and Google Pay, facilitating convenient transactions.

- Accessible Customer Support: Customer assistance is available directly within the app, ensuring prompt resolution of queries.

Cons:

- Overseas Withdrawal Fee: Basic account holders incur a 1.7% fee for overseas withdrawals, which may deter frequent travelers.

- Lack of Physical Branches: N26 operates solely through digital channels, lacking physical branch locations.

- No Overdraft Option: Unlike traditional banks, N26 does not offer overdraft facilities.

- Limited Customer Support Channels: Phone-based customer support is unavailable, with assistance primarily offered through the app.

Our editor's top digital bank picks>>

Who is it for?

N26 caters to clients from various countries, including Germany, Austria, France, Italy, Spain, Switzerland, and select European Union nations. The platform supports multiple languages and accepts clients aged 18 and above.

This is the process of opening an N26 bank account:

- The process of opening an N26 bank account is straightforward:

- Confirm your email, personal details, and shipping address.

- Select the desired account type.

- Verify your identity and connect your smartphone to the new account.

- Fund your account via bank transfer.

- Receive your N26 Mastercard by post within a few days.

Accounts & Pricing

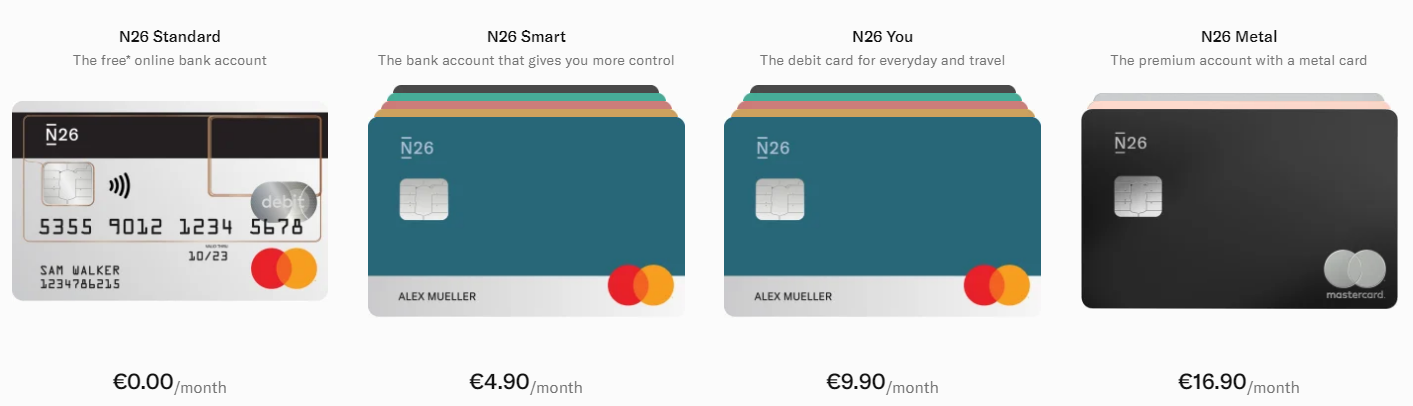

Personal Accounts:

N26 Basic:

Monthly Price: Free

-

Free ATM withdrawals: euros (only).

-

Free payments in any currency.

N26 SMART:

Monthly Price: €4.90

-

Dedicated hotline phone support with an N26 customer services representative.

-

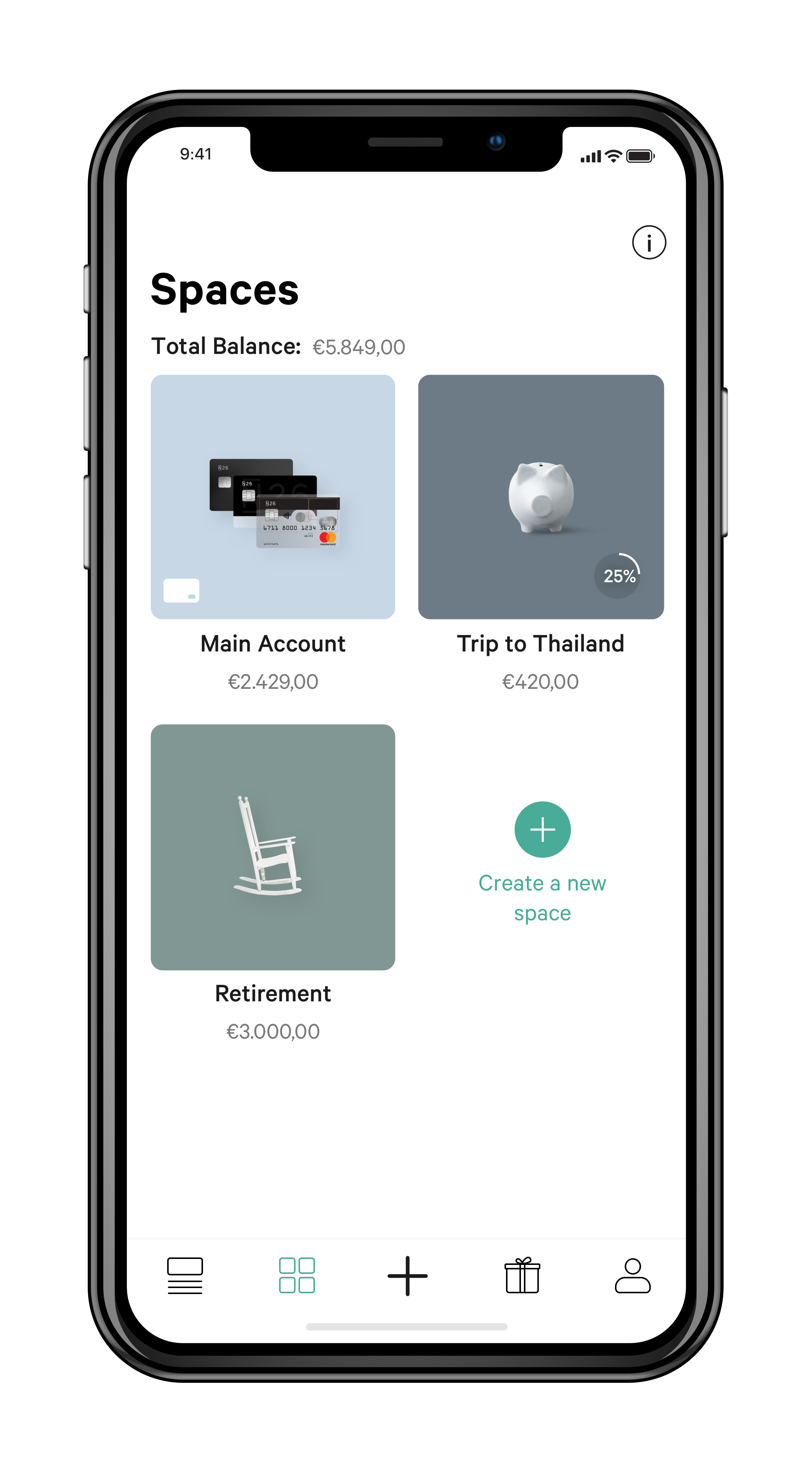

Access to up to ten ‘Spaces’ - N26’s iconic sub-accounts.

-

Access to the new Round-Ups feature, which automatically rounds up each purchase to the nearest.

N26 You:

Monthly Price: €9.90

-

Free ATM withdrawals: Worldwide.

-

Free payments in any currency.

-

Insurance package by Allianz.

-

Variety of discounts and special offers from selected partnered brands.

N26 Metal:

Monthly Price: €16.90

-

Free ATM withdrawals: Worldwide.

-

Free payments in any currency.

-

Insurance package by Allianz.

-

Variety of discounts and special offers from selected partnered brands.

-

Dedicated customer support.

-

Exclusive access to unique metal experiences.

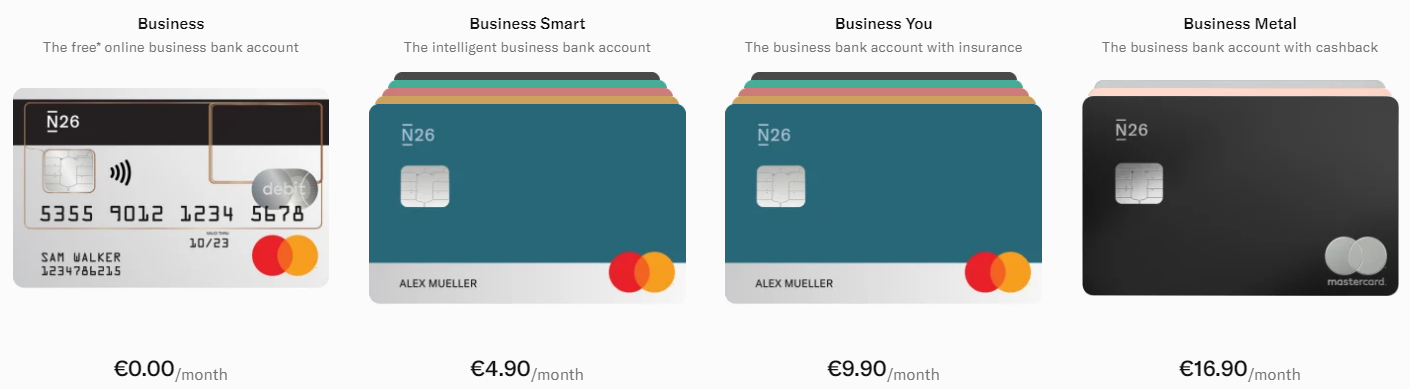

Business Accounts:

-

N26 Business:

Monthly Price: Free

-

Free ATM withdrawals: euros (only).

-

0.1% Cashback.

-

N26 Business You:

Monthly Price: €9.90

-

Free ATM withdrawals: euros (only).

-

0.1% Cashback.

-

No ATM fees in any currency.

-

Insurance package by Allianz.

Open an account with N26 in minutes>>

Key Features:

Sending / Receiving money with N26

-

Peer to Peer local transactions - N26 allows its users to make transactions between themselves using MoneyBeam instantly & for free. N26 customer can also send or receive money from non N26 customer with only an email address or phone number. the transaction will be completed within 2 banking days.

-

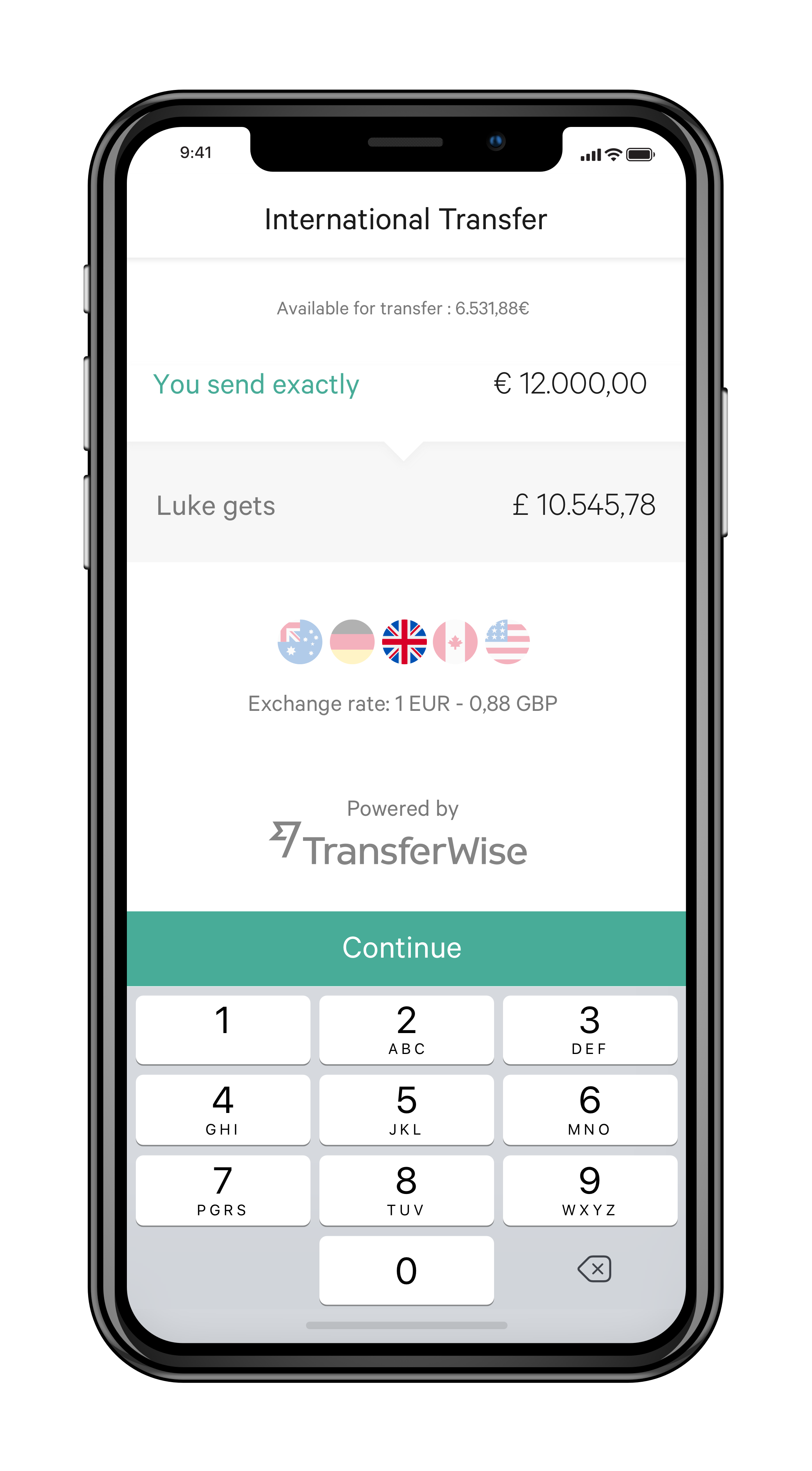

International Money Transfer - N26 allows its customers to make international transactions in over 19 foreign currencies using its built-in Transferwise feature. The fee you pay is much lower than the banks’, between 0.35-2.00% of the transaction amount, depending on the currency.

Free Mastercard debit card - Each N26 bank account will grant his owner a free Mastercard debit card, accepted worldwide.

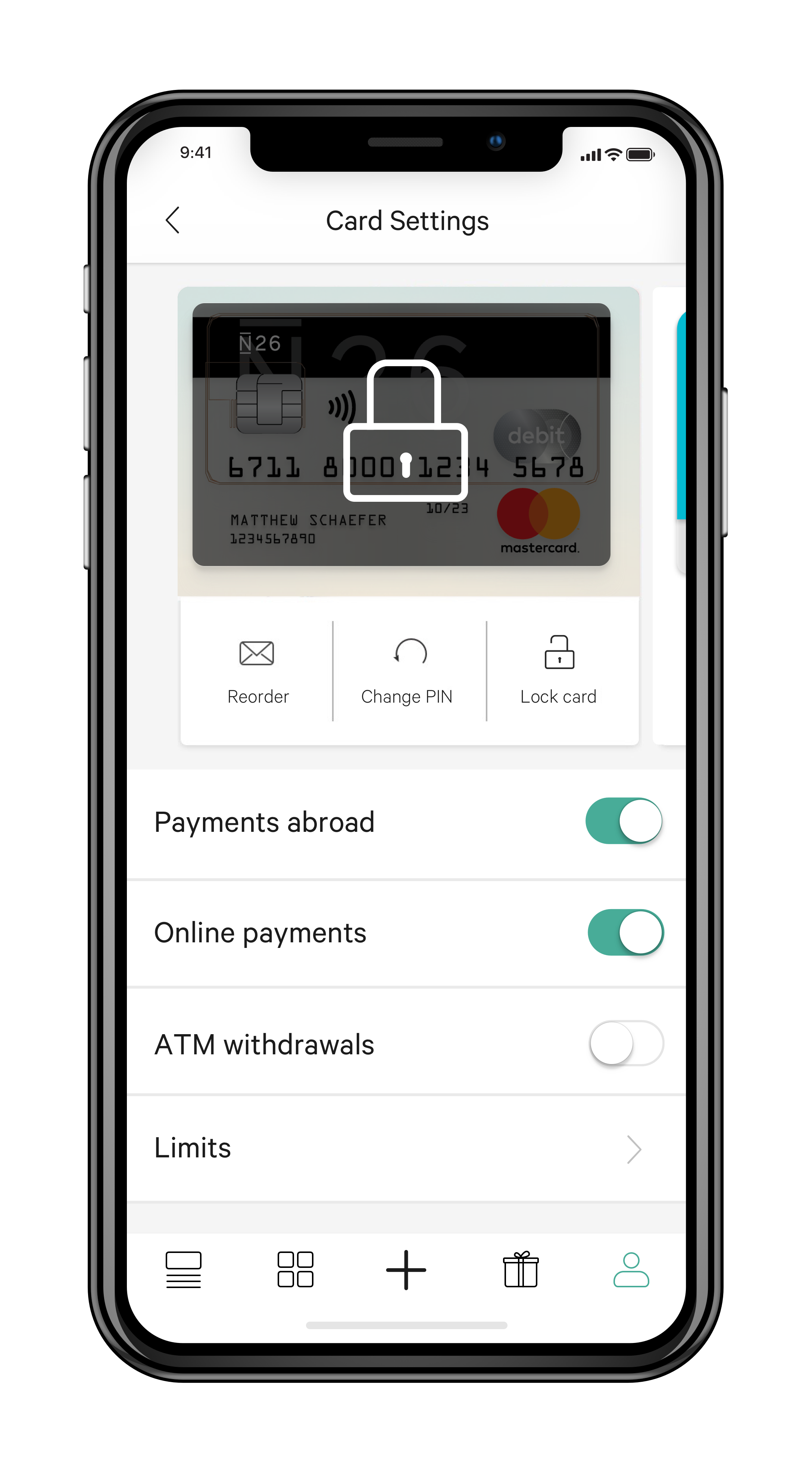

Full control via N26 app

You can use the N26 app for the following actions, from anywhere you are:

-

Set-up daily spending limits.

-

Lock or unlock your card.

-

Reset your PIN.

-

Receive push-notifications immediately for every account activity,

Including card and mobile payments, ATM withdrawals, transfers and direct debits.

-

Login to the app using secure fingerprint.

-

“N26 Spaces” - create sub-accounts for all your different goals or purposes and keep them all together. That way you can save money more easily and be in full control over your money.

-

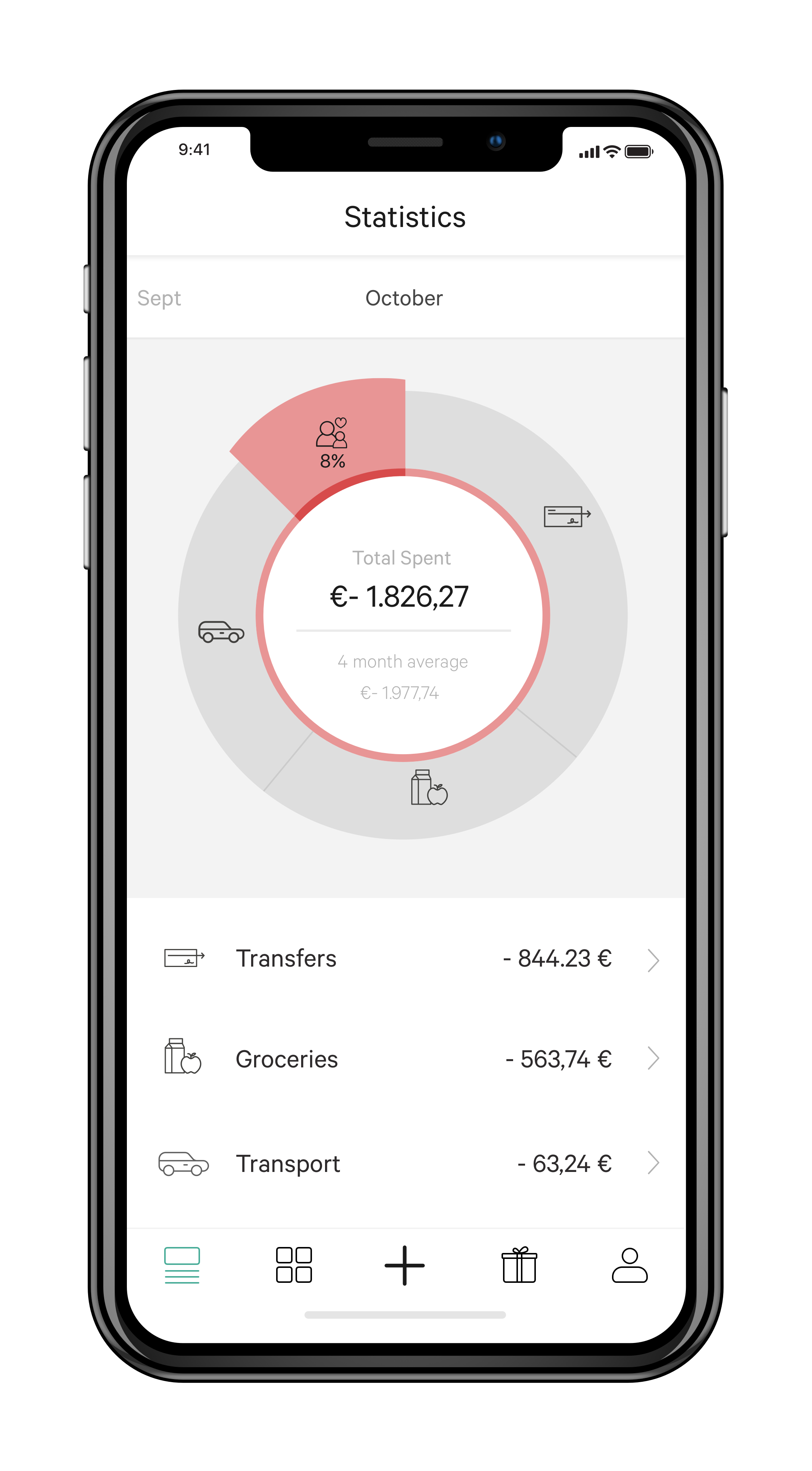

Spending Categorization - using artificial intelligence, your accounts’ spendings would be categorized and shown in your app, that way you’ll know exactly where your money goes.

-

On-line support chat in 5 languages - English, French, German, Spanish and Italian.

To sum up

N26 is a fully licensed and regulated mobile bank, allowing its customers to 100% manage their bank account online through the web or their mobile device app in real-time, from wherever they are, home or traveling.

In conclusion, N26 represents a paradigm shift in banking, offering a fully digital and feature-rich experience for managing finances. With a user-friendly app, diverse account options, and innovative features, N26 empowers customers to take control of their finances conveniently. Whether you're a frequent traveler, a tech-savvy individual, or a business owner, N26 provides tailored solutions to meet your banking needs efficiently and securely.

N26

|

96

|

- Free Standard account

- Free payments in any currency

- Free Contactless N26 Mastercard

- Free additional N26 Maestro card

- Free ATM withdrawals worldwide