Qonto Review

Company information

Founded in 2016 by Steve Anavi and Alexandre Prot, Qonto designed purely for the business market and simplified the banking and accounting of over 100,000 companies, SMEs and Freelancers.

Its mission is to "build the best banking service by using technology and design, with fair and transparent pricing!".

Since Qonto was launched in July 2017, it raised €136 million and acuired over 120,000 companies, and it is known as the 1st B2B neobank.

Pros & Cons

Pros:

-

Auto conducting VAT reconciliation.

-

International funds transfer in 18 currencies.

-

Suits for many types of business.

-

Good customer support.

Cons:

-

Only serve FR, ES, DE & IT registered business.

-

No business loans.

Who is it for

Qonto offers business accounts for freelancers, startups and SMEs, in replacement or in addition to their business banking account.

The Qonto current account is currently available to French, Italian, Spanish and German companies formed as a various legal entities. For more details, click here

Onboarding process

The application process is done entirely online and takes under 15 minutes. Once the documents are uploaded and confirmed, the account can be created in less than 1 business day.

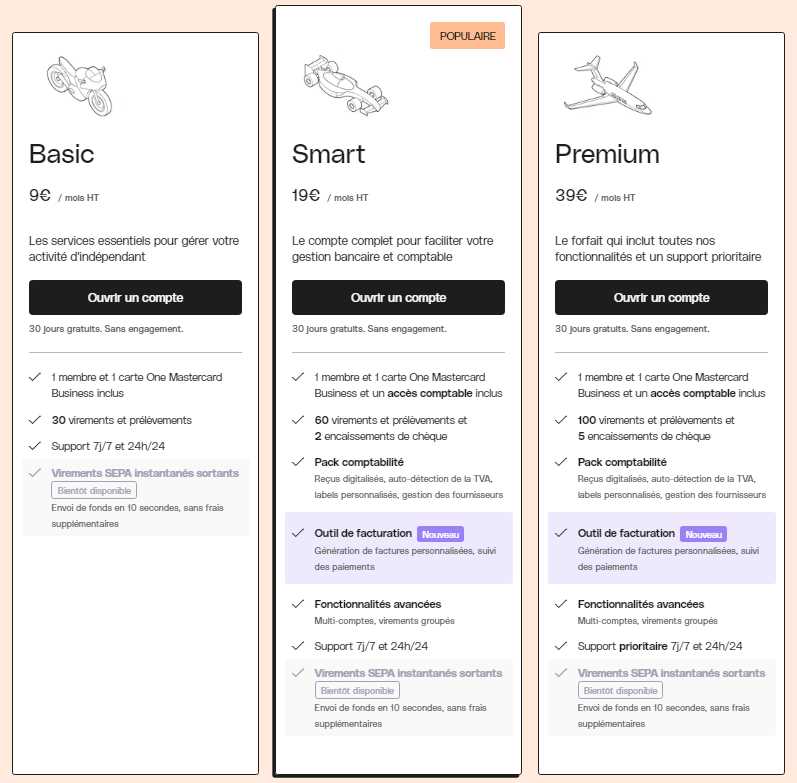

Plans

Key Features

-

Categorize expenses and automatically detect VAT

-

Accounting software (Qonto integrates with over 100 accounting tools)

-

No limit transaction history

-

Real-time notifications

-

Labels for tailor-made finance

-

Card with configurable limits

-

Bank transfer payments (unlimited for Qonto accounts)

-

Transfers in 18 foreign currencies

-

Travel Insurance

-

SEPA Direct Debit

Bottom Line

Qonto offers a great baking services and tools suits perfectly for cooporates, SMEs and freelancers needs.

Qonto's customers can save time and control their money in very convenient features: real-time notifications for better monitoring, rights and adjustable access for each employee, automatic categorization of transactions and cash flow management tables. They also benefit from exemplary customer service and fair, transparent prices

Qonto

|

96

|

- Supervised by the ACPR (Banque de France)

- French IBAN

- Freelancers / SMEs / Enterprises Accounts

- Physical & Virtual card