How to Choose the Right Mobile Bank For Me

Step 1: Define Your Needs

Before exploring digital banking options, take some time to consider your specific needs. Ask yourself questions like:

- How often will I make international transactions?

- Is the account for personal or business use?

- Will this be an everyday account or for specific transactions only?

Understanding your banking habits is essential in matching your needs with the features offered by digital banks.

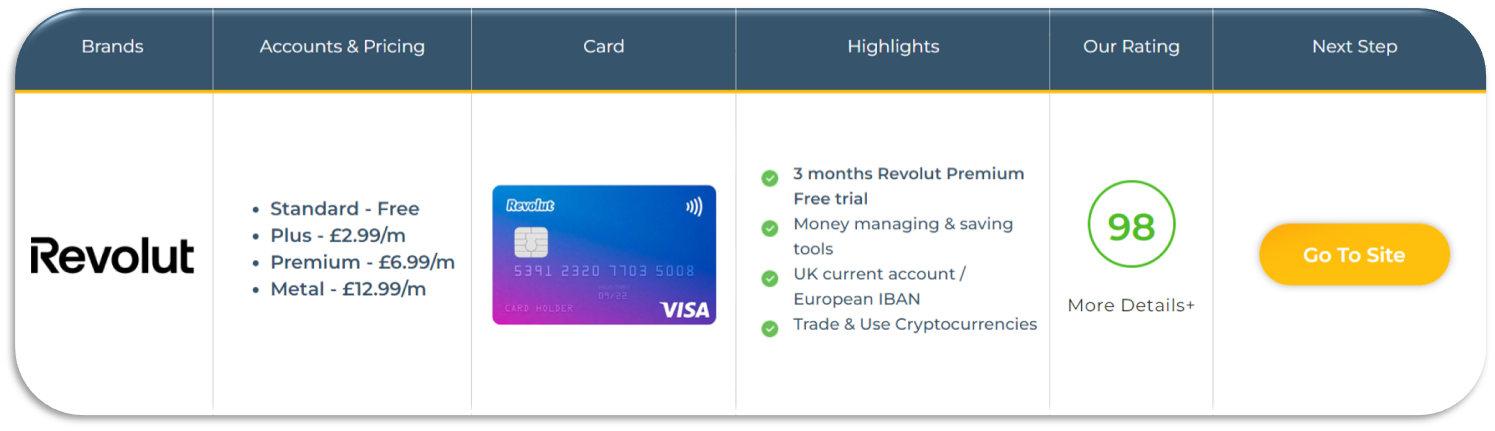

Step 2: Consider Fees and Charges

Once you have defined your needs, the next step is to consider the fees associated with different digital banks. This includes:

- Examining exchange rates and international transaction fees if you frequently travel abroad.

- Identifying whether fees differ between personal and business accounts.

- Understanding the structure of transfer fees, overdrafts, top-ups, and card replacements.

A thorough examination of fees ensures that you choose a digital bank that aligns with your financial habits and minimizes unexpected charges.

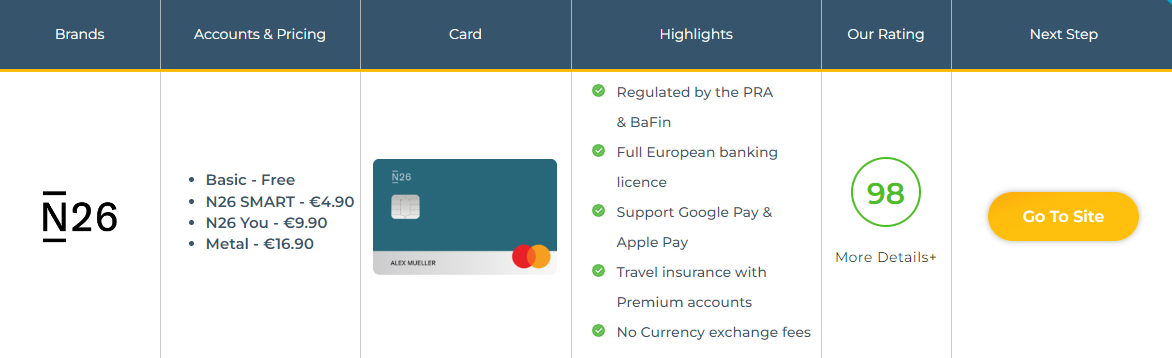

Best for controlling your spending – N26

Step 3: Prioritize Security Measures

As digital banking becomes increasingly prevalent, ensuring the security of your funds is crucial. Look into the security measures implemented by digital banks and assess whether you are comfortable with them.

This includes encryption protocols, authentication methods, and fraud detection systems. A secure banking environment is vital for maintaining the integrity of your financial transactions.

Step 4: Explore Payment Options

Different digital banks offer different payment options, from traditional debit cards to entirely online transactions. Consider:

- Your preferred method of making purchases.

- Whether the bank has partnerships with payment services like PayPal or Apple Pay.

Choosing a bank that aligns with your preferred payment methods enhances convenience and streamlines your financial transactions.

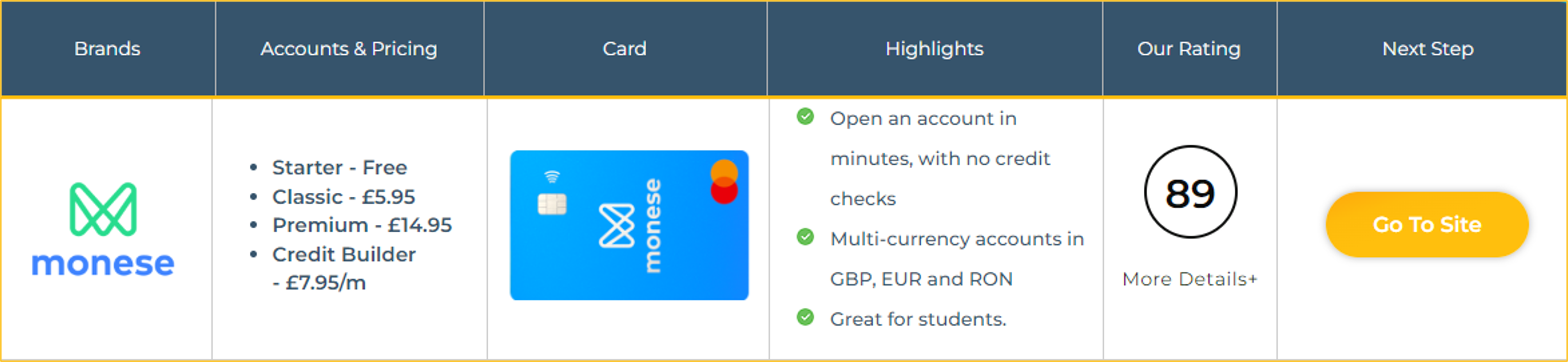

Best for students and new arrivals - Monese

Step 5: Assess User-Friendliness

When it comes to digital banking, the user interface is a crucial element of the overall banking experience. It is important to evaluate the following factors:

- The availability of recurring transaction options to simplify repetitive processes.

- The ease of navigation on the bank's website or mobile app.

- Any potential sources of confusion in the interface.

Opting for a digital bank with a user-friendly interface ensures a seamless and frustration-free banking experience.

In conclusion, selecting the best digital bank involves a thoughtful process that considers personal needs, fees, security measures, payment options, and user-friendliness. By following these steps, users can make an informed decision that aligns with their financial preferences. As the financial landscape continues to evolve, choosing the right digital bank is a crucial step toward modern and efficient banking.