Revolut Business Review

Revolut Business is a comprehensive financial solution designed for both small startups and large enterprises, offering a wide range of features that cater to the diverse needs of today's businesses. From multi-currency accounts and cost-effective international transfers to corporate cards and expense management, Revolut Business seeks to streamline financial operations, reduce unnecessary fees, and provide real-time financial insights.

Ease of Use and Interface:

Ease of Use and Interface:

Revolut Business offers a user-friendly interface, accessible both via its website and a mobile app. Setting up an account is straightforward, allowing businesses to start managing their finances quickly. The dashboard provides a clear overview of your finances, including balances, transactions, and analytics, making it easy to monitor your business's financial health at a glance.

Financial Management and Tools:

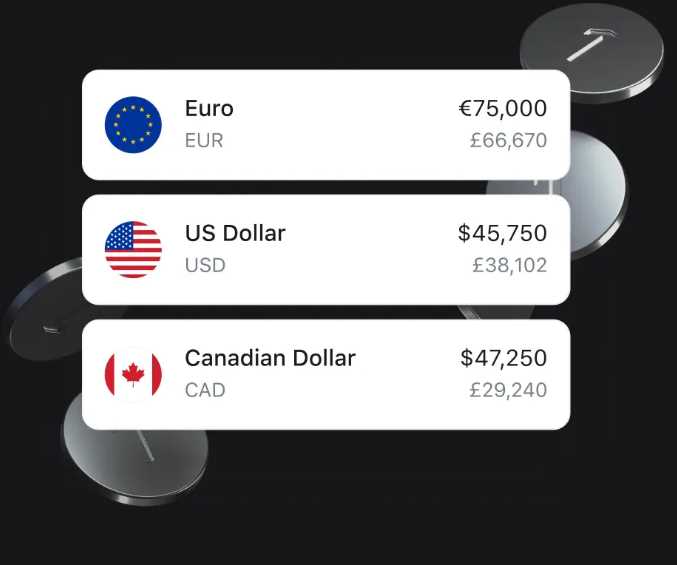

One of the standout features of Revolut Business is its robust set of financial management tools. The platform supports holding, sending, and exchanging money in multiple currencies, which is a significant advantage for businesses operating internationally. Real-time exchange rates and the ability to hold funds in different currencies can offer savings on foreign exchange fees.

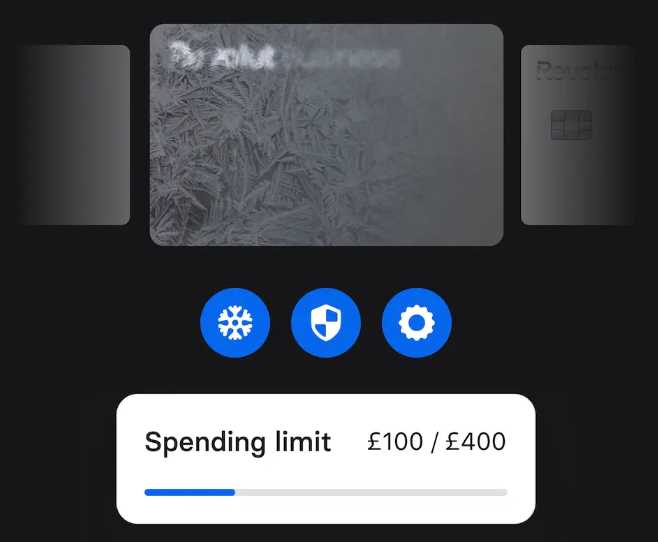

Corporate Cards and Expense Management: Revolut Business provides corporate cards that can be issued to employees, helping to simplify expense reporting and approval workflows. The platform offers powerful expense management features, including setting spending limits, instant notification of transactions, and the ability to freeze/unfreeze cards through the app. This level of control over expenses is invaluable for maintaining budget discipline and preventing unauthorized spending.

Corporate Cards and Expense Management: Revolut Business provides corporate cards that can be issued to employees, helping to simplify expense reporting and approval workflows. The platform offers powerful expense management features, including setting spending limits, instant notification of transactions, and the ability to freeze/unfreeze cards through the app. This level of control over expenses is invaluable for maintaining budget discipline and preventing unauthorized spending.

Integrations and API:

The integration capabilities and API access offered by Revolut Business are among its most powerful features, designed to streamline and automate financial operations for businesses. These aspects cater to the evolving needs of modern enterprises, ensuring that they can maintain efficiency and adaptability in their financial processes.

Integration with Accounting Software

Revolut Business integrates seamlessly with several leading accounting software platforms. This connectivity allows for automatic synchronization of transactions into the accounting ledger, simplifying the reconciliation process. By linking Revolut Business accounts directly with accounting software like Xero, QuickBooks, and others, businesses can save significant time and reduce errors associated with manual data entry. This integration is crucial for maintaining up-to-date financial records, aiding in more accurate financial reporting and analysis.

Customer Support:

Customer service is an essential aspect of any business service. Revolut Business has made efforts to provide support through various channels, including in-app chat, email, and phone support, aiming to resolve issues promptly. However, as with many service providers, the quality of support can vary, and some users may experience longer wait times or unresolved queries.

Security: Security is a top priority for Revolut Business, which employs several measures to protect accounts and transactions. Features like two-factor authentication, the ability to instantly freeze/unfreeze cards, and customizable permissions enhance the security of business finances.

Security: Security is a top priority for Revolut Business, which employs several measures to protect accounts and transactions. Features like two-factor authentication, the ability to instantly freeze/unfreeze cards, and customizable permissions enhance the security of business finances.

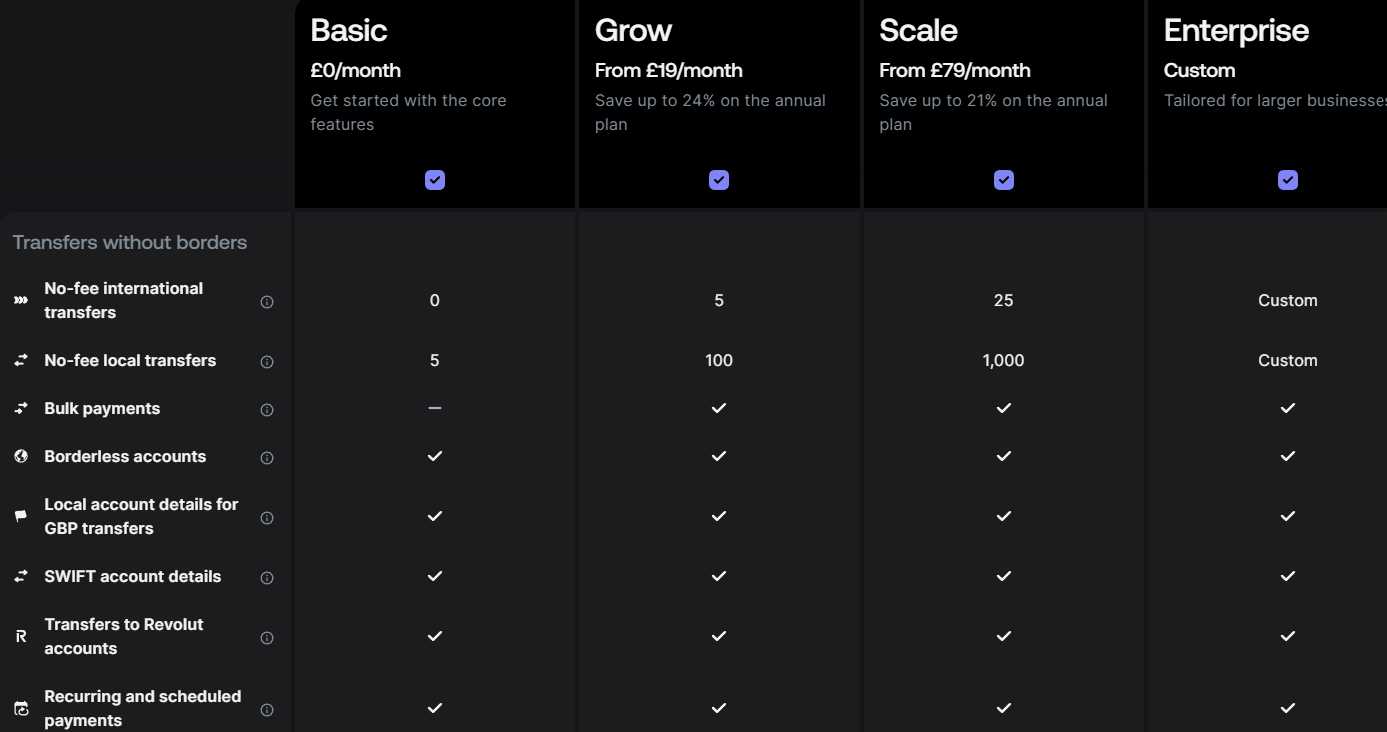

Pricing:

Revolut Business offers different pricing plans to suit various business sizes and needs, from freelancers to large corporations. While some basic services are available for free, more advanced features and higher usage limits are included in paid plans. Businesses should assess the cost against the value of the features provided to determine the most appropriate plan for their needs.

Conclusion:

Revolut Business stands out as a dynamic and flexible financial platform for modern businesses, offering a range of features designed to simplify financial management, save on fees, and support international operations. While it offers significant advantages, businesses should consider their specific needs, especially concerning customer support and the costs associated with the more advanced features.

The tools provided by Revolut Business stand out as transformative features for businesses seeking to modernize and streamline their financial operations. By leveraging these tools, businesses can achieve a higher level of efficiency, accuracy, and insight into their financial health, all of which are critical components for sustaining growth and competitiveness in today's market.

For the most current information and user reviews, visiting the Revolut Business website or consulting with current users can provide valuable insights into whether it's the right choice for your business needs.

How To Choose The Right Business Account For Your Needs

Choosing the right business account is a crucial decision for any company, impacting its operational efficiency, financial management, and growth potential. Here are some key factors to consider when selecting a business account:

Fees and Charges:

Understand the fee structure associated with the account, including monthly fees, transaction fees, ATM charges, and any other potential costs. Some accounts offer fee waivers under certain conditions, such as maintaining a minimum balance.

Interest Rates:

If the account yields interest, compare rates across different banks. An account with a higher interest rate can generate additional income for your business.

Online and Mobile Banking Features:

In today's digital age, having access to robust online and mobile banking features is essential. Look for accounts that offer easy-to-use platforms for managing your finances, making payments, and monitoring transactions in real time.

Integration with Accounting Software:

Some business accounts integrate directly with accounting software like QuickBooks, Xero, or FreshBooks. This can streamline financial management, making it easier to track expenses, send invoices, and prepare for tax season.

Access to Credit and Lending Products:

Consider whether the bank offers access to credit lines, loans, or credit cards that could support your business's growth and cash flow needs.

Customer Service and Support:

Reliable customer support is vital, especially for resolving financial issues quickly. Look into the bank's customer service options, availability, and the quality of support provided.

Security Measures:

Ensure that the bank uses up-to-date security measures to protect your account from unauthorized access and fraud. Features like two-factor authentication, encryption, and fraud monitoring can provide additional layers of security.

Branch and ATM Access:

If your business requires frequent cash deposits or withdrawals, consider the location of the bank's branches and ATMs. Some banks also offer fee-free access to a network of ATMs.

Additional Services and Perks:

Some accounts offer additional benefits, such as rewards programs, discounts on business services, or cashback on purchases. These perks can add value to your business operations.

Regulatory Compliance and Protection:

Ensure that the bank is regulated by the appropriate financial authorities and that your deposits are protected up to the insured limit.

Revolut Business